New Research: Purchase Intent For Hybrids and EVs Has Reached An Inflection Point in North America

Research Contents

We have just completed new research into consumer perceptions of the changes taking place in the automotive sector. The study, which focuses primarily on likely car buyers in North America, gathered insights from over 1200 adults 18 and up in the United States and Canada. Among the key themes that our research helps us gain more clarity on are changes in sentiment and purchase intent for hybrid vehicles and electric vehicles (EVs) versus gasoline vehicles, and key drivers of purchase intent for consumers relative to each of the three engine technologies. As expected, the data is already turning out to be fascinating, and we look forward to sharing many of our findings with you in the coming months.

Let’s start things off with the fundamentals: How do consumers currently view hybrids, EVs, and gasoline vehicles;, and what does their purchase intent for each vehicle category look like?

North American Car Buyers Shift Near-Term Purchase Intent to Hybrids and EVs

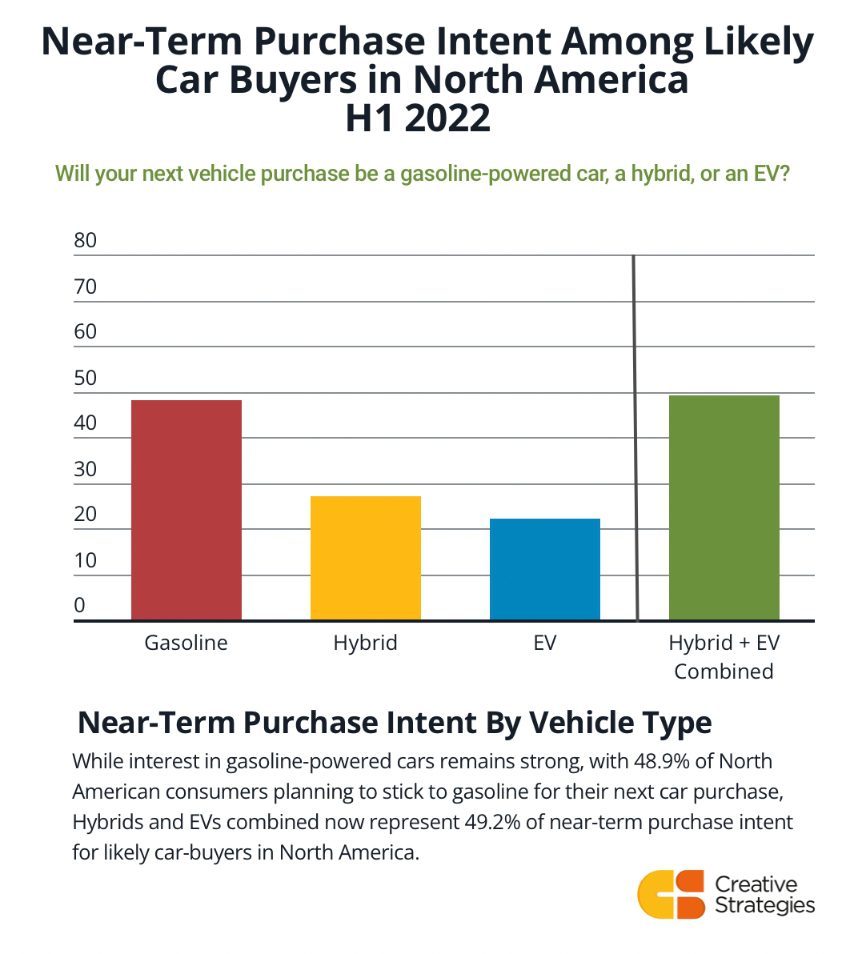

Our data suggests that purchase intent for EVs and hybrids has reached an inflection point, with 49.2% of respondents signaling that they want their next car to be a hybrid or an EV, versus 48.9% of respondents signaling that their next car will be gasoline-powered.

In other words, not only are likely car buyers in North America currently split almost 50/50 between those planning to stick with gasoline-powered vehicles for their next car purchase and those turning to hybrid or EV alternatives, but purchase intent for hybrids and EVs combined appears to have overtaken purchase intent for legacy gasoline-powered cars. This is a significant demand-driver milestone for automakers to consider as they race to bring more hybrid vehicles and EVs to market.

Favorability For Hybrid Vehicles and EVs is Also Growing, Signaling Growth in Future Demand

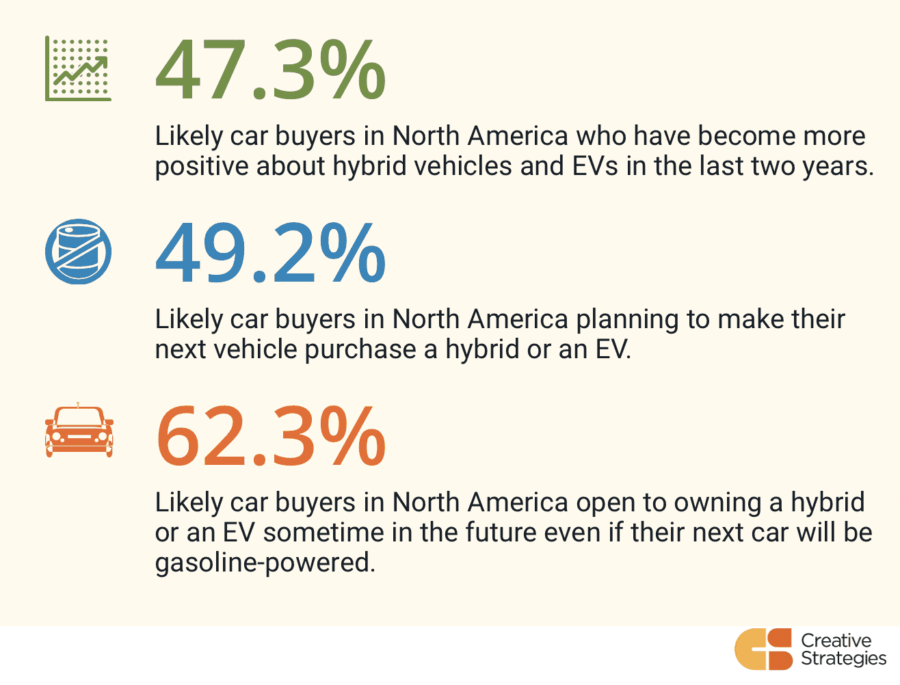

Our research also shows that among the 48.9% of consumers who plan to stick to gasoline engines for their next vehicle purchase, 62.3% signal that they are open to owning a hybrid or an EV at some point in the future, just not right now. Reasons for putting off an EV purchase for now range from pricing friction and technology anxiety to concerns about range per charge and uncertainty about access to charging infrastructure. We plan to discuss these reasons in more detail soon, so keep an eye on this space.

An additional bit of good news for automakers focusing on expanding their offering of hybrid vehicles and EVs is that 47.3% of likely car buyers have become more positive about hybrid vehicles and EVs in the last two years. In contrast, only 7.8% of likely car buyers feel less positive about hybrids and EVs than they did two years ago. The remaining 45.1% report that their opinions (positive or negative) have remained unchanged in the same timeframe.

To recap:

- Nearly half (47.3%) of likely car buyers in North America have become more positive about hybrid vehicles and EVs in the last two years.

- Nearly half (49.2%) of current likely car buyers in North America plan for their next vehicle to be a hybrid or an EV.

- Nearly 2 in 3 (62.3%) of likely car buyers whose next car will likely still be powered by a legacy gasoline engine are open to owning a hybrid or an EV sometime in the future.

Looking at these data points together, my three biggest takeaways for the automotive industry are:

- Favorability towards hybrid vehicles and EVs among North American consumers has significantly increased in the last 24 months.

- Growing favorability for hybrid vehicles and EVs continues to drive a shift in consumer demand in North America away from gasoline and towards more energy-efficient alternatives.

- Purchase intent for hybrids and EVs combined now exceeds purchase intent for gasoline-engine cars among likely North American car buyers.

Taken together, these market signals are good news for automakers already working to increase hybrid and EV production to meet future consumer demand in North America, and help validate expectations of growing hybrid and EV demand. Additionally, these signals may, over time, help automakers gauge both the pace and degree to which they should realistically plan to phase out gasoline vehicles altogether in favor of more popular energy-efficient and ecologically-friendly alternatives.

These insights barely scratch the surface of our research. Look for more analysis soon.